Discover Assurance with Offshore Trust Services: Maintain Your Assets

Diving In for Financial Freedom: Discovering Offshore Depend On Services as a Portal to International Riches Management

Look no further than overseas trust fund services as your entrance to global wide range management. In this short article, we will certainly guide you with the ins and outs of understanding offshore depend on solutions, the benefits they provide in terms of property security, just how to pick the ideal offshore territory, and vital factors to consider for constructing your own depend on.

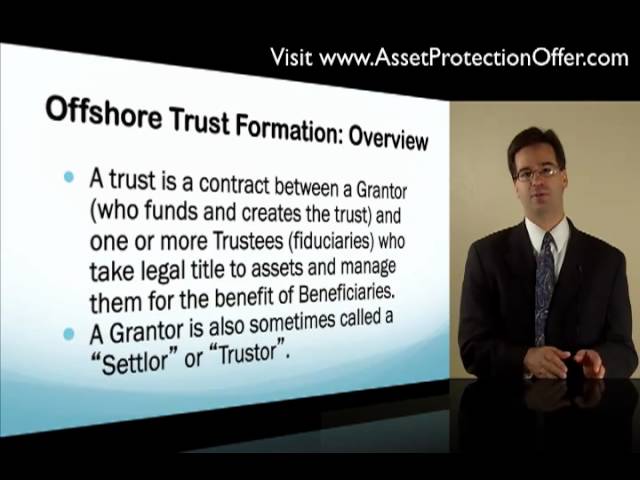

Comprehending Offshore Depend On Solutions: A Key to Global Wide Range Administration

Comprehending offshore trust fund solutions is necessary for those looking for to involve in international wide range administration - offshore trust services. Offshore counts on are an effective device that enables people to secure and expand their assets in a private and tax-efficient manner. By positioning your assets in an overseas depend on, you can gain from lawful and monetary advantages that are not available in your house country

Among the main benefits of offshore depend on solutions is the capability to minimize tax obligation liabilities. Offshore territories usually have much more favorable tax obligation laws, enabling you to legally lower your tax worry. This can lead to substantial cost savings and raised riches buildup in time.

An additional advantage of offshore depends on is the level of possession defense they provide. By putting your properties in a jurisdiction with strong property defense legislations, you can protect your wide range from potential creditors, claims, or various other financial dangers. This can offer you assurance knowing that your hard-earned money is safe.

Furthermore, offshore depend on solutions supply a high level of privacy and privacy. Offshore territories prioritize customer discretion, guaranteeing that your monetary events continue to be exclusive. This can be particularly helpful for people that value their privacy or have worries concerning the safety of their assets.

Benefits of Offshore Trust Services in International Asset Protection

Optimize your possession protection with the benefits of overseas trust fund services in protecting your international wide range. Unlike standard onshore trust funds, offshore trust funds use a better level of personal privacy, making sure that your monetary affairs stay very discreet and safeguarded from prying eyes. offshore trust services.

One more considerable benefit of overseas count on solutions is the adaptability they provide in regards to wealth monitoring. With an overseas count on, you have the ability to diversify your properties throughout different territories, enabling you to take advantage of desirable tax obligation programs and investment chances. This can result in substantial tax obligation cost savings and raised returns on your investments.

Additionally, overseas trust services offer a higher degree of property defense compared to residential trusts. In case of a lawful conflict or economic crisis, your offshore trust fund can act as a shield, securing your properties from potential lenders. This included layer of defense can provide you with assurance and make sure the durability of your wealth.

Exploring Offshore Jurisdictions: Choosing the Right Area for Your Trust Fund

When choosing the best overseas territory for your count on, it's vital to consider elements such as tax obligation benefits and lawful structure. Offshore territories use an array of advantages that can aid protect your assets and maximize your financial administration. By carefully thinking about these elements, you can select the best offshore jurisdiction for your count on and embark on a journey towards economic freedom and international wide range monitoring.

Structure Your Offshore Count On: Key Considerations and Strategies

Choosing the best territory is vital when building your offshore trust fund, as it figures out the level of lawful defense and stability for your properties. Constructing an offshore depend on requires mindful factor to consider and tactical preparation. You need to identify your goals and objectives for the count on. Are you wanting to protect your possessions from potential claims or creditors? Or maybe you wish to decrease your tax responsibilities? It is essential to study and evaluate various jurisdictions that straighten with your needs when you have actually defined your goals. Seek jurisdictions with strong lawful structures, political stability, and a desirable tax atmosphere. In addition, consider the track record and record of the jurisdiction in managing overseas trust funds. Seek click to investigate guidance from specialists that specialize in offshore trust fund services, such as attorneys or riches supervisors, that can guide you with the process and assist you browse the intricacies of overseas jurisdictions. Each jurisdiction has its very own set of regulations and regulations, so it is important to recognize go to this web-site the lawful and financial implications before making a choice. By putting in the time to very carefully pick the right territory, you can make sure that your overseas count on supplies the degree of defense and stability you desire for your possessions.

Optimizing Returns: Investing Approaches for Offshore Depends On

Buying a varied profile can assist offshore trusts accomplish greater returns. One of the most vital aspects to think about is how to maximize your returns when it comes to handling your overseas count on. By expanding your investments, you can alleviate threat and enhance the capacity for better gains

Primarily, it is necessary to understand the idea of diversity. This approach involves spreading your investments throughout various asset classes, markets, and geographical areas. By doing so, you are not putting all your eggs in one basket, which can help safeguard your profile from possible losses.

When selecting investments for your offshore depend on, it's necessary to take into consideration a mix of properties, such as stocks, bonds, realty, and products. Each possession course has its very own threat and return qualities, so by purchasing a variety of them, you can potentially benefit from different market conditions.

Additionally, remaining informed concerning market patterns and economic signs is crucial. By staying up-to-date with the current information and occasions, you can make informed like this investment decisions and adjust your portfolio accordingly.

Conclusion

So now you know the advantages of overseas trust fund solutions as an entrance to worldwide riches administration. By recognizing the crucial factors to consider and techniques included in building your offshore trust fund, you can optimize your returns and secure your possessions. Choosing the right overseas territory is vital, and with the appropriate financial investment techniques, you can dive in in the direction of financial freedom. Welcome the chances that offshore count on services supply and begin on a trip towards global riches administration.

In this short article, we will certainly guide you through the ins and outs of recognizing overseas trust services, the benefits they provide in terms of possession security, how to select the best offshore territory, and crucial considerations for developing your own depend on. Unlike typical onshore counts on, offshore counts on provide a better level of privacy, ensuring that your monetary affairs stay very discreet and secured from prying eyes.

Additionally, overseas depend on solutions offer a higher degree of possession protection contrasted to residential trust funds.Choosing the appropriate jurisdiction is important when constructing your offshore count on, as it establishes the degree of legal protection and stability for your possessions. Look for suggestions from professionals who specialize in offshore count on services, such as legal representatives or wealth managers, who can direct you with the procedure and aid you browse the intricacies of overseas territories.